20+ debt ratio mortgage

Ad Compare Home Financing Options Online Get Quotes. The debt-to-income DTI ratio is a personal finance measure that compares an individuals debt payment to his or her overall.

Debt To Income Ratio What Is A Good Dti For A Mortgage

Monthly debts for DTI include.

. It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan. Web Here are debt-to-income requirements by loan type. Lock Your Rate Today.

Our Technology Will Match You With The Best Lenders At Super Low Rates. Web To determine your debt-to-income ratio also called your back-end ratio start by adding up all your monthly debt payments. Once the equity in your property increases to 20 the mortgage insurance is canceled.

For example if your make 4000 a month and pay 1500 for credit cards 300 for a car. Web A lot of factors go into that assessment and the main one is debt-to-income ratio. Web Most traditional lenders require a maximum household expense-to-income ratio of 28 and a maximum total debt to income ratio of 36 for loan approval.

Apply Now To Enjoy Great Service. Ad Compare the Best House Loans for March 2023. Web Debt-To-Income Ratio - DTI.

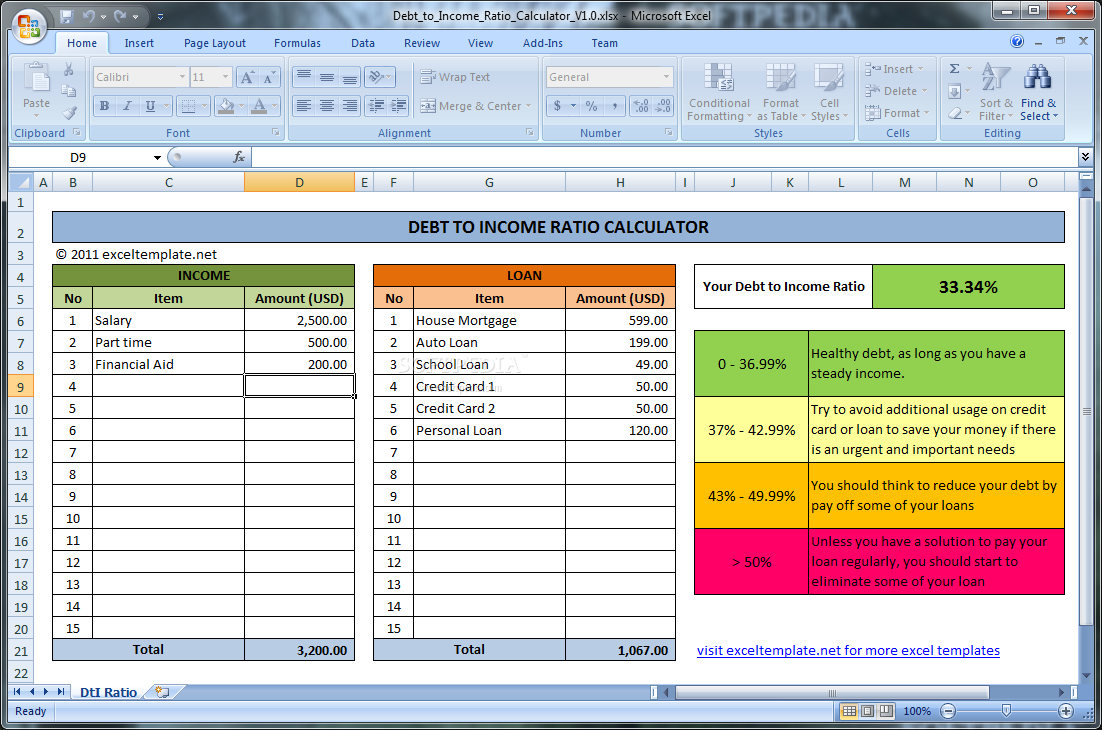

Web A debt-to-income or DTI ratio is derived by dividing your monthly debt payments by your monthly gross income. Over 15 Million Customers Since 2005. Youll usually need a back-end DTI ratio of 43 or less.

Thats your current debt-to-income ratio. Web To qualify for an FHA loan you generally must have a FICO score of at least 580 and a debt-to-income ratio DTI of 43 or less including student loans. Lock In Your Rate With Award-Winning Quicken Loans.

Compare More Than Just Rates. Follow Dream For All Conventional first mortgage guidelines for maximum total Debt-to. Ad Compare Best Mortgage Lenders 2023.

You have a pretax income of 4500 per month. If your home is highly energy-efficient and you. Get Instantly Matched With Your Ideal Mortgage Lender.

Ad Highest Satisfaction for Mortgage Origination. Summary for Lowering Debt-To-Income Ratio The. Get Instantly Matched With Your Ideal Mortgage Lender.

Web providing first-time homebuyers with up to 20 of the home purchase price to be used for. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. - SmartAsset Mortgage lenders typically look for debt-to-income ratios of 36 or lower.

Web Lenders use it to measure your ability to handle mortgage payments. Your monthly expenses include 1200. Find A Lender That Offers Great Service.

The ratio is expressed as a percentage and lenders use it to. Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage. Apply Get Pre-Approved Today.

Web A 20 down payment might remove private mortgage insurance PMI charges from your monthly costs but its not always required to buy a home. Divide your total monthly debts as defined in Step 1 by your gross income as defined in Step 3. Web However the mortgage lender must document the probability that this new part-time employment will continue.

Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Web Whats an Ideal Debt-to-Income Ratio for a Mortgage.

Apply Online Get Pre-Approved Today. Web This ratio says that your monthly mortgage costs which includes property taxes and homeowners insurance should be no more than 36 of your gross monthly income and. Lock Your Rate Today.

Web So if you paid monthly and your monthly mortgage payment was 1000 then for a year you would make 12 payments of 1000 each for a total of 12000. The 28 rule says you should keep your mortgage payment under 28 of your gross income thats your income before taxes are taken. How Much Interest Can You Save By Increasing Your Mortgage Payment.

Apply Get Pre-Approved Today. Ad A Rating With Better Business Bureau. Web Divide Step 1 by Step 3.

Web Debt-to-income ratio total monthly debt paymentsgross monthly income. Ad Compare the Best House Loans for March 2023. But with a bi-weekly.

Mortgage Loans In Miami Miami Home Loans American Bancshares

Loan To Value Ratio Ltv Formula Calculator

Qualifying For A Mortgage With Student Loans Find My Way Home

What Is A Debt Service Coverage Ratio Loan Get Rental Property Loans With No Income Verification Bigreia Com

Cmp 14 10 By Key Media Issuu

Debt To Income Ratio Calculator Windows Download

What Is The Best Debt To Income Ratio For A Mortgage Bankrate

What Is A Good Debt To Income Ratio To Have In 2023

Evaqqqjm54bl8m

Bill Beggs Mortgage Broker Provident Mortgage Services Linkedin

Dave Ramsey Mortgage Advice Should You Buy A House With Student Loans Debt Free Doctor

Leverage Ratios For U S Households Loan To Value Ltv Versus Debt To Download Scientific Diagram

2023 Guide To Qualifying For A Mortgage With Student Loans Find My Way Home

What S An Ideal Debt To Income Ratio For A Mortgage Smartasset

Mortgage Debt Ratio And Balance Sheet Of Dutch Households A Dutch Download Scientific Diagram

Need A Mortgage Keep Debt Levels In Check The New York Times

November 2022 Newsletter The Long Term Fiscal Spiral Lyn Alden